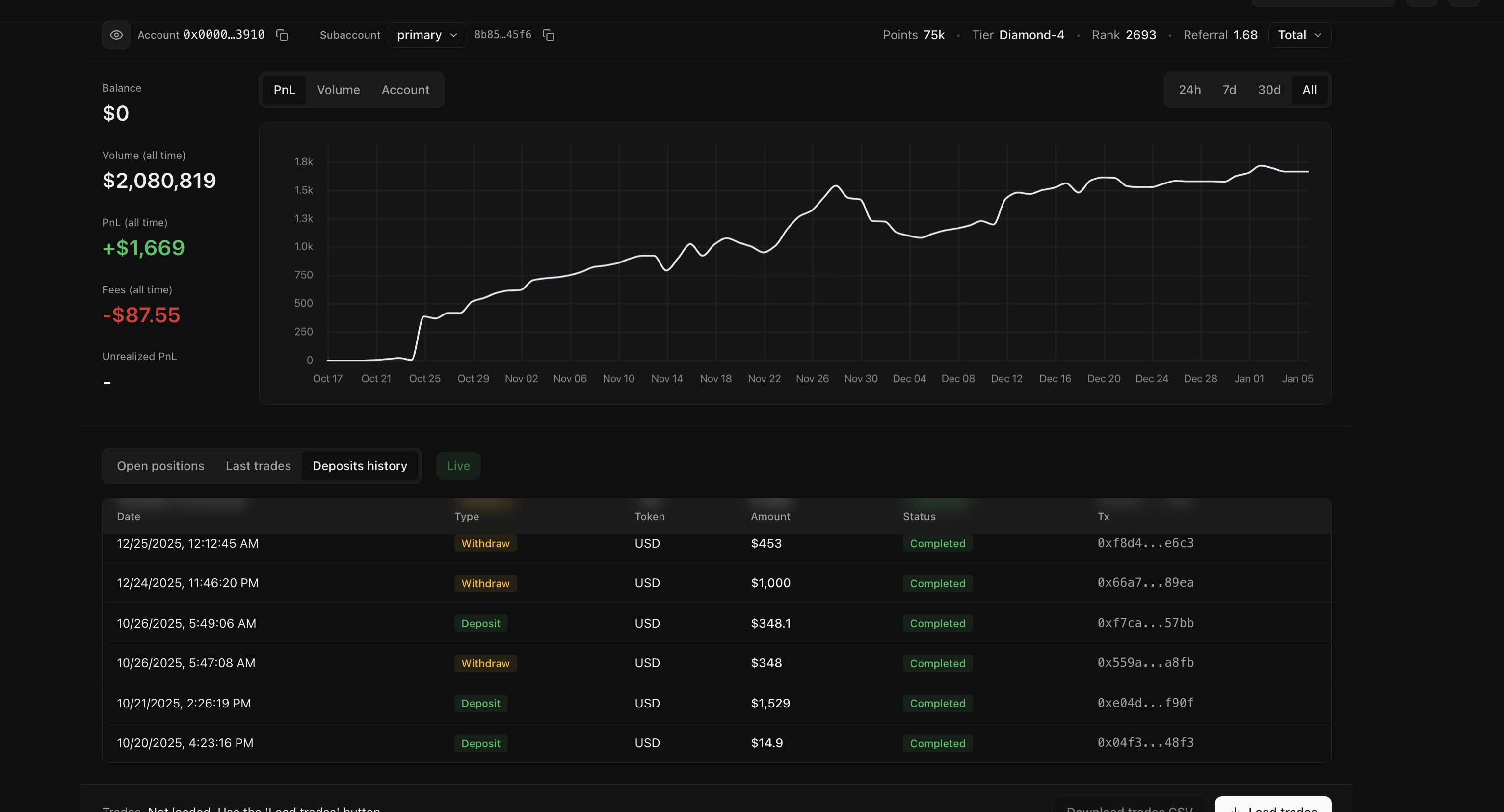

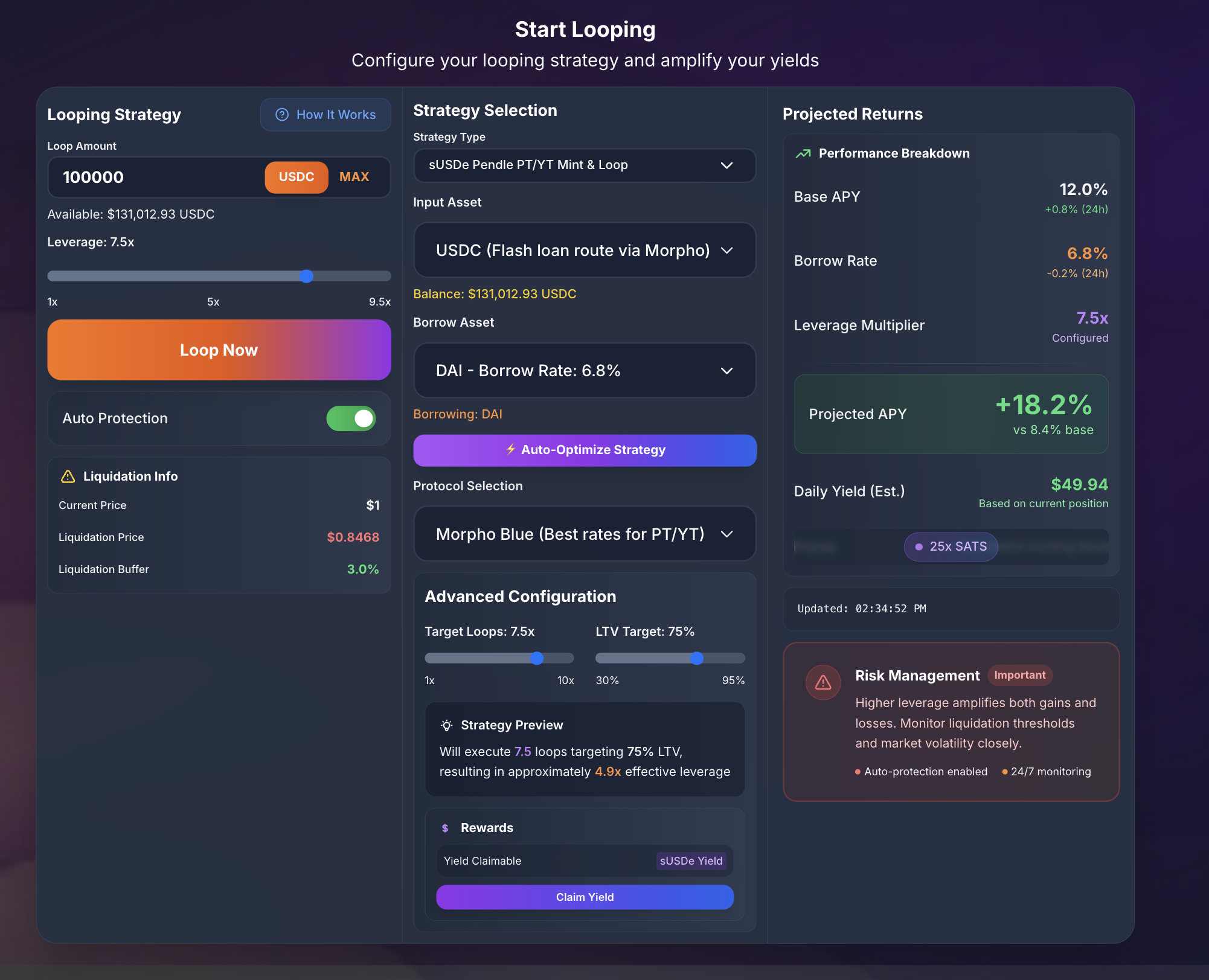

sUSDe Strategy with Morpho Flash Loan

One-click deployment with up to 9.5x leverage. Choose between Morpho Blue or Balancer for flash loans

How Our Interface Works

sUSDe Pendle PT/YT Mint & Loop with 7.5x Leverage using a Morpho Flash Loan.

Advanced Risk Management

⚡ Start Loop StrategyAbility to add/remove collateral, adjust loop count and set notifications for health factor thresholds via notif.network